ModConnect April 2025

Top picks this month

- Compliance and regulatory updates

- Changes to CHAPS payments from 1st May 2025

- Webhooks for Payment Approvals & Rejections

New this month

Webhooks for Payment Approvals & Rejections

A new webhook is now available to support payments that require user approval. When a payment is approved or rejected, your system will receive a real-time webhook notification—allowing you to immediately update internal records and prompt users to take any necessary action.

This is particularly important when a payment is rejected, as your system can now notify users straight away that a resubmission is required—avoiding any unnecessary delays or confusion.

You can learn more about how to implement this webhook here: Webhook - Payment Approval Status Change.

Upcoming Change

Changes to CHAPS payments from 1st May 2025

Changes to CHAPS payments from 1st May 2025

The Bank of England has required all CHAPS participants to update their services as part of its ISO20022 Enhanced Data initiative. The changes mean that extra information is mandatory when executing certain typesof CHAPS payments and generally recommended to be supplied if available.

Note: A CHAPS payment will only be sent when the payment value exceeds £1m and the CHAPS service is enabled for the sending account.

What’s changing for payments made by CHAPS

The Modulr create payment endpoint has three additional parameters from 1st May. All new parameters are optional when creating a payment as default values will be used where not supplied, they must be specified by you only in certain circumstances when making specific types of CHAPS payments.

- Legal Entity Identifier – When making a CHAPS payment to a financial institution* the LEI of the institution must be included

- Payment Purpose Code – This must be included in CHAPS transactions relating to property (see note below). For all other payments unless a value is specified, this field default will be “EPAY” (e-payment). We do generally encourage use of appropriate Purpose Codes for all transactions.

- Payment Category Code – An optional category code for the payment. Unless a value is specified, the default will be “OTHR” (other)

*Defined as a payment to PRA authorised deposit-takers or broker-dealers, or Financial Market Infrastructures supervised by the Bank of England only; for clarity it does not mean an account of a client held at an institution, only a payment to the institution itself.

Please refer to Modulr API Documentation for a full list of Purpose and Category Codes.

Payment purpose codes for property transactions

When making a CHAPS payment (a payment over £1m on the Modulr platform) related to a property transaction, one of the following purpose codes must be used where the purpose applies.

- HLRP - Property Loan Repayment

- HLST - Property Loan Settlement

- PLDS - Property Loan Disbursement

- PDEP - Property Deposit

- PCOM - Property Completion Payment

- PLRF - Property Loan Refinancing

Change to Direct Debit Outbound service - incoming payment webhook behaviour

To support accurate calculation of daily ARUDD (Automated Return of Unpaid Direct Debits) totals—a critical part of the ARUDD liquidity process that all partners should now be using—the behaviour of the incoming collection webhook will be updated from 19th May.

As part of this change, the webhook will now trigger for all incoming Direct Debit transactions. This includes Direct Debits that are immediately rejected by the Modulr system on Day 2, where the transaction cannot be applied (for example, due to a closed account or a cancelled mandate). These previously unreported rejections are now included to ensure daily ARUDD totals are fully accurate and comprehensive.

To support this enhancement, two new fields— statusand rejectionCode—have been added to the webhook payload. These allow you to identify immediate rejections and understand the reason behind them. All other aspects of the webhook remain unchanged.

If you have not yet adopted the ARUDD liquidity process, please speak with your account manager for guidance and next steps.

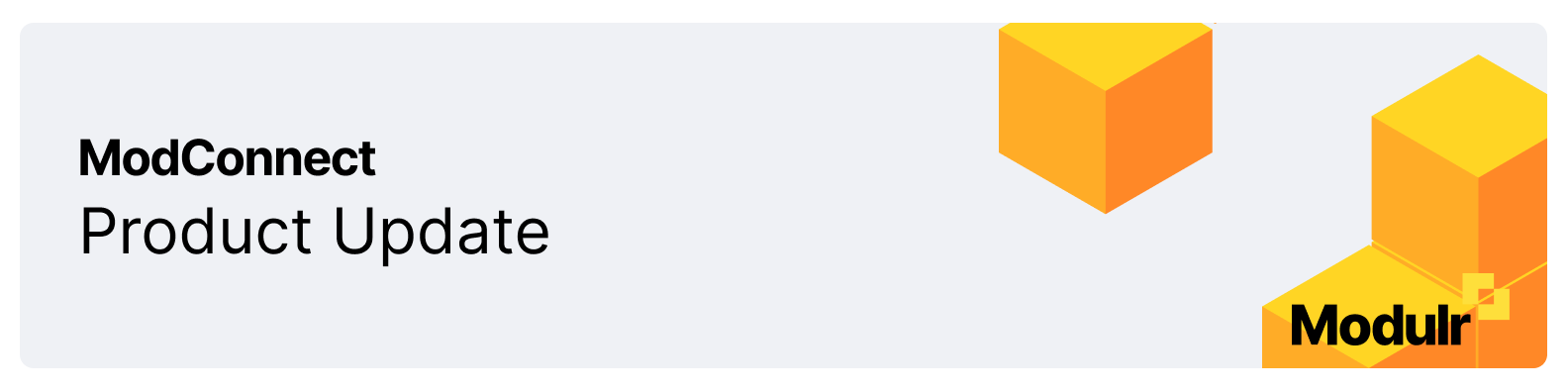

Updated Applications and Customers view

Customers View: Improved Usability and Search

The Customers view has been updated to provide a more intuitive and efficient experience when managing customer records.

- The ‘COMPLIANCE STATUS’column has been renamed to ‘Status’, with simplified and clearer labels: ‘Active’, ‘In Review’, and ‘Declined’—making it easier to understand each customer’s current state at a glance.

- A new ‘Manage’ button has been introduced for each customer, giving you quicker access to key actions and details.

The search functionality now also aligns with the experience in other areas of the customer portal. Simply type the customer’s name into the search bar and press Enter to locate them.

Additionally, you can now download a CSV file of the customers listed on the current page, making it easier to export and review subsets of data.

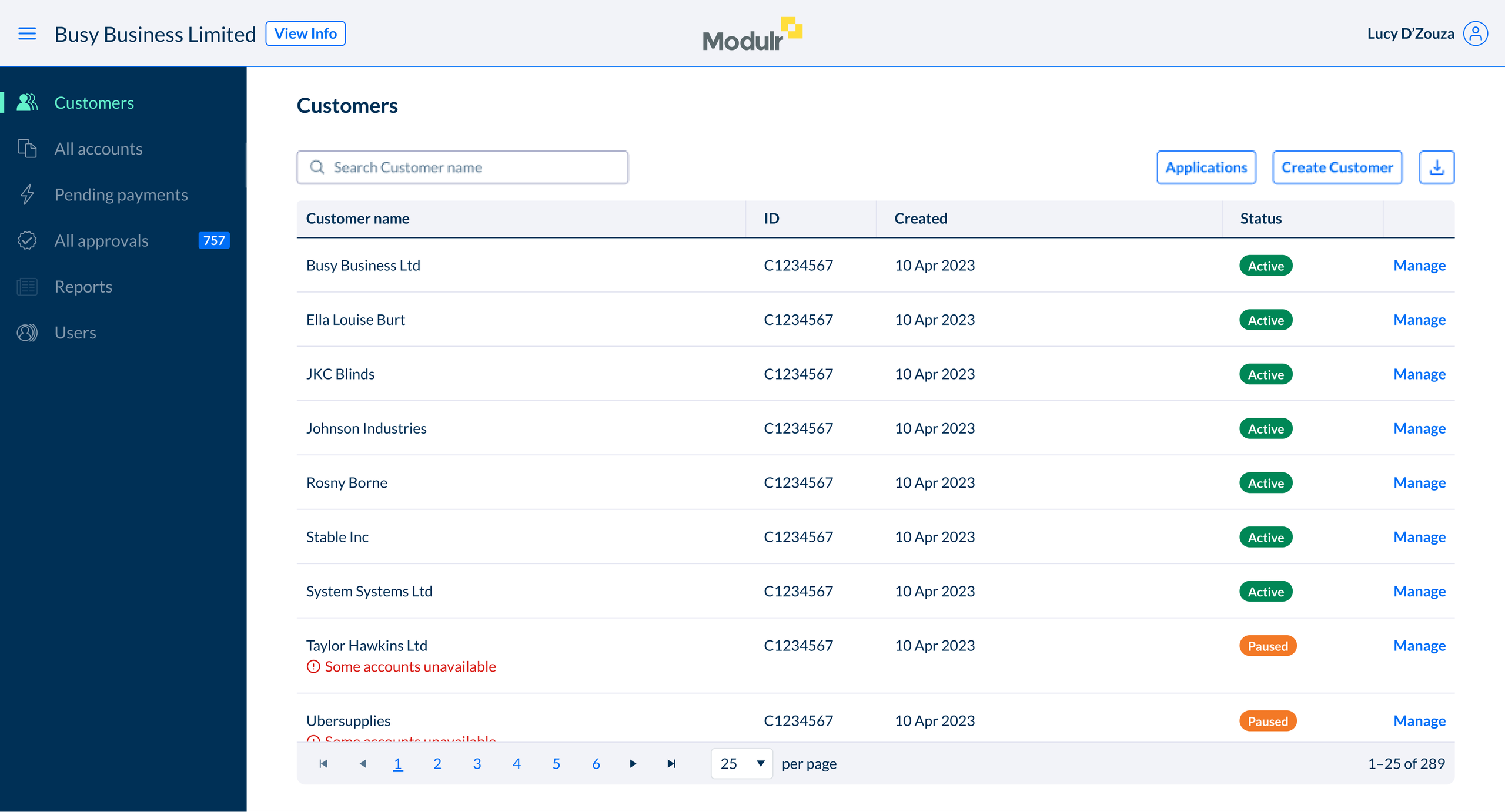

Applications view: Complete redesign for simpler navigation

The Applications view has been completely redesigned to make it faster and easier to manage customer onboarding workflows.

- A new type-ahead search box lets you quickly find applications by customer name.

- You can now filter and sort applications by name or status to focus on what’s most relevant.

- Filtered results can be downloaded as a CSV file, helping you extract exactly what you need.

We’ve also added a ‘Create Customer’ button directly within this view, allowing you to initiate customer creation without switching screens.

Looking ahead, we’re working on additional self-serve functionality—such as the ability to cancel applications and remove declined customers—to give you even greater control and flexibility.

Compliance and regulatory updates

Sharing the results of our Money Mule data collection

The Financial Conduct Authority (FCA) has conducted a thematic review focused on detecting and preventing money mule activities within payment account providers. This initiative aligns with the Economic Crime Plan 2 and the National Fraud Strategy, emphasising the importance of disrupting mule operations to protect the public and maintain the integrity of the financial system.

What are Money Mules? Money mules are individuals who, knowingly or unknowingly, transfer illicit funds on behalf of criminals, thereby facilitating money laundering and fraud.

Data Collection and Insights

At the beginning of 2025 and 2024 Modulr requested information from 40 agents and distributors regarding money mule activities identified in the previous year, and the demographics of those involved. We present a summary of the findings here to aid partners so they are implementing robust controls and comprehensive transaction monitoring, so that together, we can reduce financial crime.

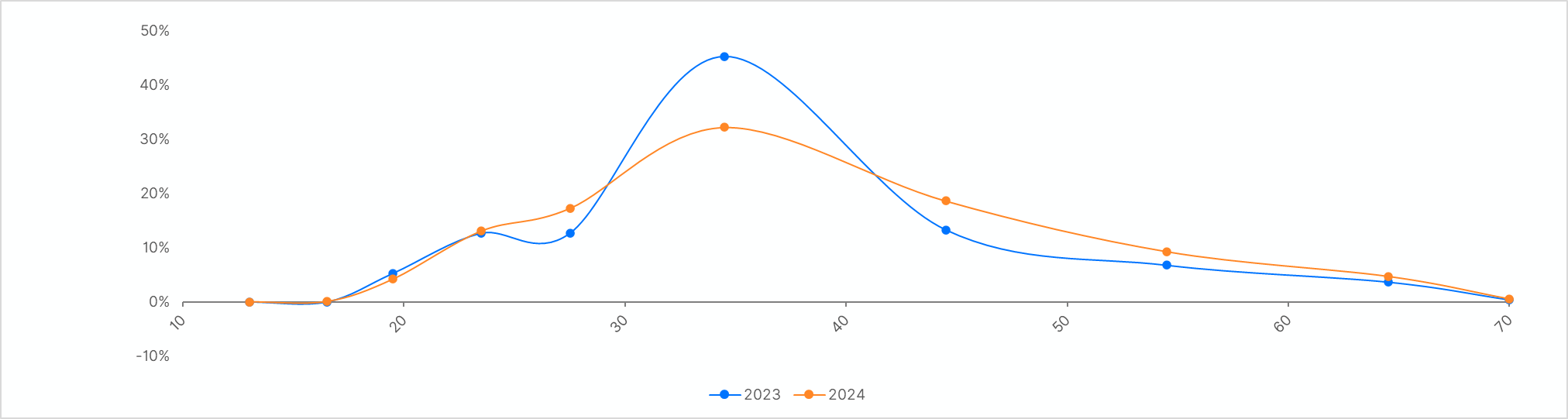

Age

The industry typically reports that the most common age range for money muling is between 18 and 30 however, we actually see the most activity in the 30-39 with 45% of money mules falling in this age bracket in our 2023 data. Between 2023 and 2024 the spread of ages involved has widened, with the proportion of money mules in 40-49 and 50-59 age bracket increasing.

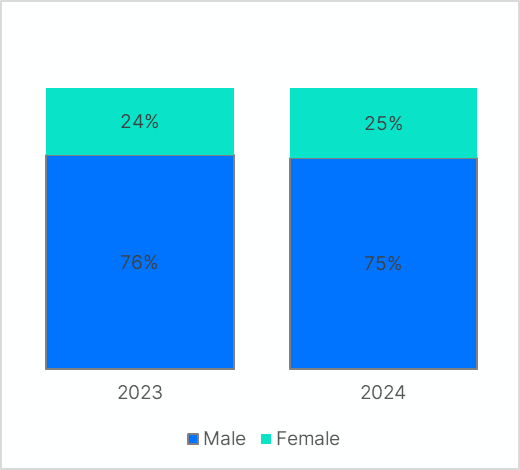

Gender

Money Mules identified in our data were three quarters male, with minimal change between 2023 and 2024.

Entity type

As expected almost all money mules identified were individuals rather than businesses. The number of businesses identified did increase from 2023 to 2024 but only from 0.2% to 0.5%.

FCA Dear CEO letter

The FCA recently published a Dear CEO letter outlining their priorities for payment firms across three themes that are essential to good customer outcomes. The FCA outlines their expectations around topics such as financial resilience, operational resilience, and consumer duty. Modulr has reviewed our own performance against these priorities at a board level, and it is a requirement that our partners, in particular our UK Agents and Distributors do the same. These Partners must align with these priorities through their work with Modulr’s Partner Oversight team, familiarise themselves with the letter and conduct a similar exercise.